Amazon’s Ad Business Worth $350 Billion: Analyst

Amazon’s stock price is ignoring the company’s booming advertising business, according to Jefferies analyst Brent Thill, who now values the segment at $350 billion. Thill upped his estimate from $300 billion, citing a surge in consumers flocking to Amazon for grocery shopping as a result of the pandemic.

The 3 Top Reasons Walmart Wants a Piece of TikTok

Walmart is considering a joint bid for TikTok and the increasingly blurred line between retail and social commerce is one of the key reasons that TikTok’s viral video factory would accelerate sales for Walmart.

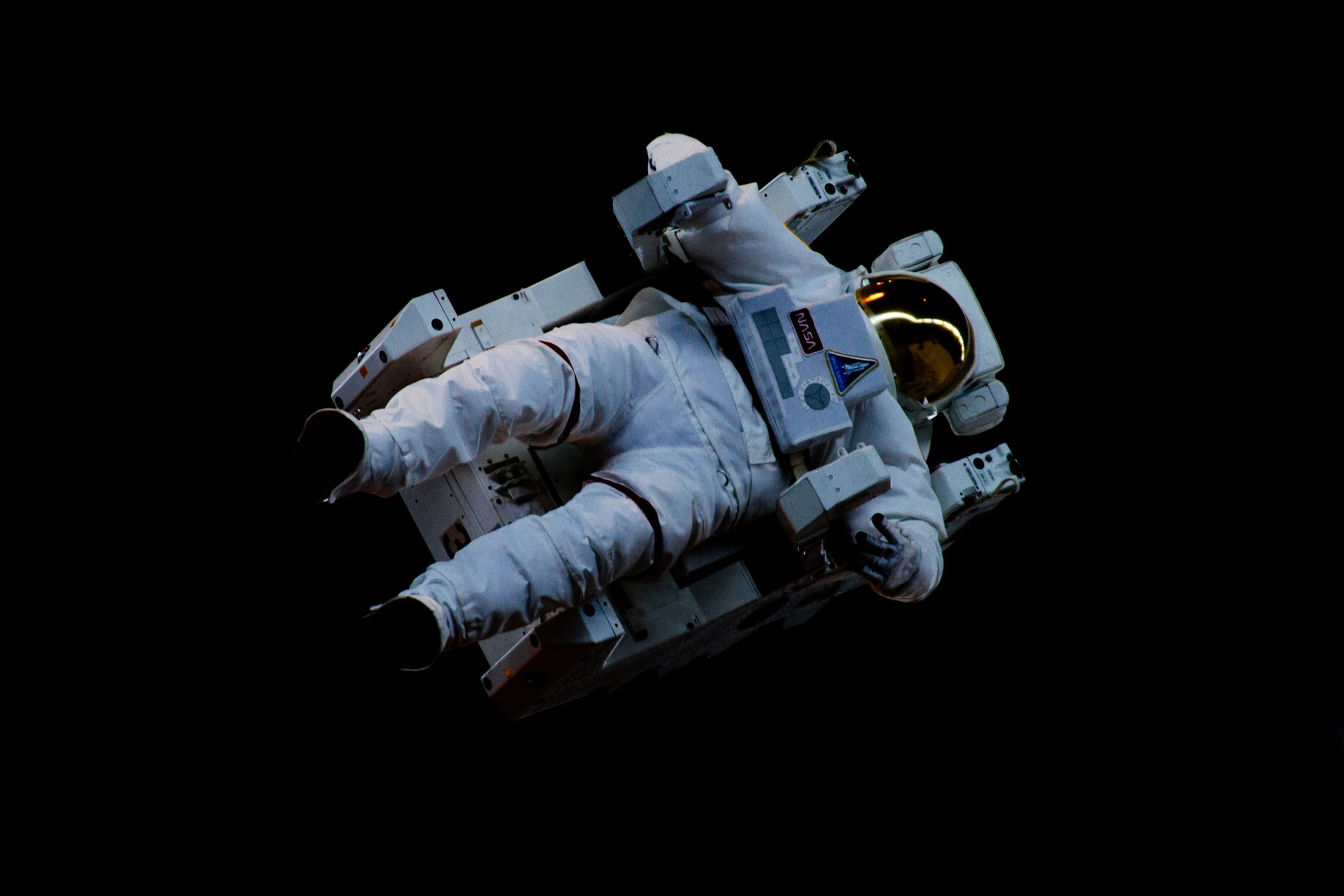

Virgin Galactic Scores Bullish Call, $22 PT from Cowen

Cowen says buy Virgin Galactic because of its first-mover advantage in commercial spaceflight and exposure to point-to-point hypersonic travel. The research firm initiated coverage of Virgin Galactic with an Outperform rating and a $22 price target.

Upcoming Corsair Gaming IPO Highlights Rise of Gaming, eSports, and Streaming

Corsair Gaming is a provider of high-performance gear for gamers & content creators. It leads U.S. market share in categories including keyboards, power supply units, & high-performance memory. The company filed to go public on Friday and will trade under the symbol CRSR.

Instagram Reels Might be the Real Deal

Facebook’s answer to TikTok has a chance to also be a solution for driving Instagram’s next leg of growth. A new survey conducted by Jefferies indicates Reels is an early success and suggests the video product has potential to keep more users inside the app for longer.

Disney Needs the NBA and NFL

Sports fans are loving the overlap of NBA playoff basketball and working from home, but no one loves it more than ESPN and Disney, which is the media company that can gain the most from the return of live sports.

Peloton PT Raised to $72 a share by Stifel

Peloton has changed the fitness industry forever, and demand for the connected fitness bike will remain elevated over the next several quarters, according to Stifel analyst Scott Devitt. The firm raised its price target to $72 a share from $62.

Pressure Mounts for Lyft as Rideshare Rebound Stalls and California Shutdown Looms

Ridesharing is bouncing back slower than expected, and the delay is taking a toll on Lyft’s business and testing the patience of Wall Street. Lyft reported weak second quarter results with revenue tanking 61% y/y.

PENN Rides the Gaming Wave Ahead of Barstool Sportsbook Launch, Analyst Raises PT to $62

Penn National Gaming’s better-than-expected reopening at brick and mortar locations in the recent quarter, combined with investor exuberance for the upside from online betting, is sending shares of the casino stock soaring.

Uber’s New Reality is that Delivery > Rides

Uber delivered mixed Q2 results, with delivery continuing to serve as a safety net while mobility recovers slower than expected.

Roku’s Audience Growth is Impressive, But Ad Outlook Remains Fuzzy

Roku is finding itself caught between two diverging trends, and investors are stuck choosing which to weigh more heavily. As an aggregator of streaming entertainment content, Roku is a clear winner emerging from the mass exodus from cable television. The problem in the near-term is, however, the lack of visibility into digital advertising strength, which Roku is heavily reliant on.

Ranking Big Tech’s Earnings Performance

Apple, Amazon, Alphabet, and Facebook all reported earnings Thursday. Here is a look at how each of them fared.

Impact of Spotify’s Podcast Splurge Remains Unclear

Spotify’s guidance for the second half of 2020 indicates upcoming podcast content does not seem to be increasing 2020 monthly active users compared to prior expectations, according to Wells Fargo media analyst Steven Cahall.

Why Tesla’s Profit Win Streak Matters and Makes It Look Like Amazon

Tesla shares continue to defy gravity following a beat on Q2 expectations. Revenues for the quarter were $6 billion, above consensus of $5.2 billion. The big story, though, is that Tesla notched its 4th consecutive quarter for the first time ever. Non-GAAP EPS was $2.18 vs. consensus loss of $0.48.

Snap’s “Puzzling” Earnings Results Cool Off the Stock and Raise Questions About TikTok

Snap delivered better-than-expected revenue for the latest quarter despite shrinking ad budgets from major advertisers who are struggling with the pandemic, but the social media company disappointed investors with slower-than-anticipated user growth and conservative guidance.

Ridesharing’s Rebound is Stuck in Traffic

Ridesharing’s rebound is taking longer than expected as activity in major cities remains stagnant due to persistent fears related to the pandemic and the reimplementation of strict social distancing requirements by certain states.

Why Wall Street Got Netflix Earnings Wrong

Weak Q3 subscriber guidance is overshadowing a record 2nd quarter for Netflix. Q3 guidance of 2.5 million was lower than 5.3 million consensus on Wall Street due to demand pull-forward related to the pandemic, according to some analysts.

Domino’s Pizza Rakes in the Dough

The pandemic is making the world's largest pizza restaurant by sales even stronger. In Q2, sales of $920 million and earnings of $2.99 a share grew by about 13% and 36% from a year ago, respectively. U.S. same-store sales surged 16.1% in Q2 from a year earlier. 2019’s Q2 growth was just 3%.

Apple Services and Wearables to Push Stock to $450: Needham

Apple’s Services and Wearables segments will fuel the company’s ecosystem and drive growth in revenue per user for years to come, according to Needham analyst Laura Martin. The firm raised its price target for the iPhone maker to $450 from $350 on Wednesday.